auto repair insurance cost decoded for real savings

You want less surprise bills and more trust in your budget; understanding pricing delivers that faster than chasing coupons. I focus on savings without losing reliability, then pick coverage that matches how you actually drive.

What shapes your rate

- Deductible size: higher deductible, lower monthly cost.

- Vehicle age and mileage: older, higher risk, pricier.

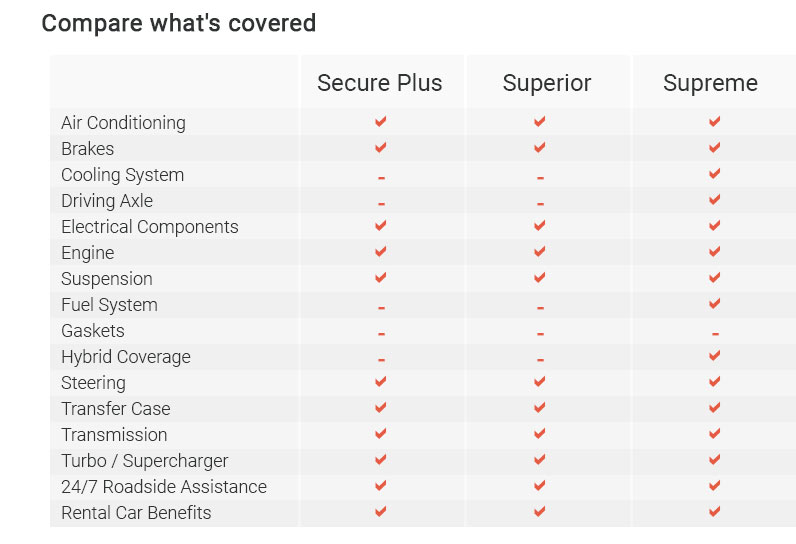

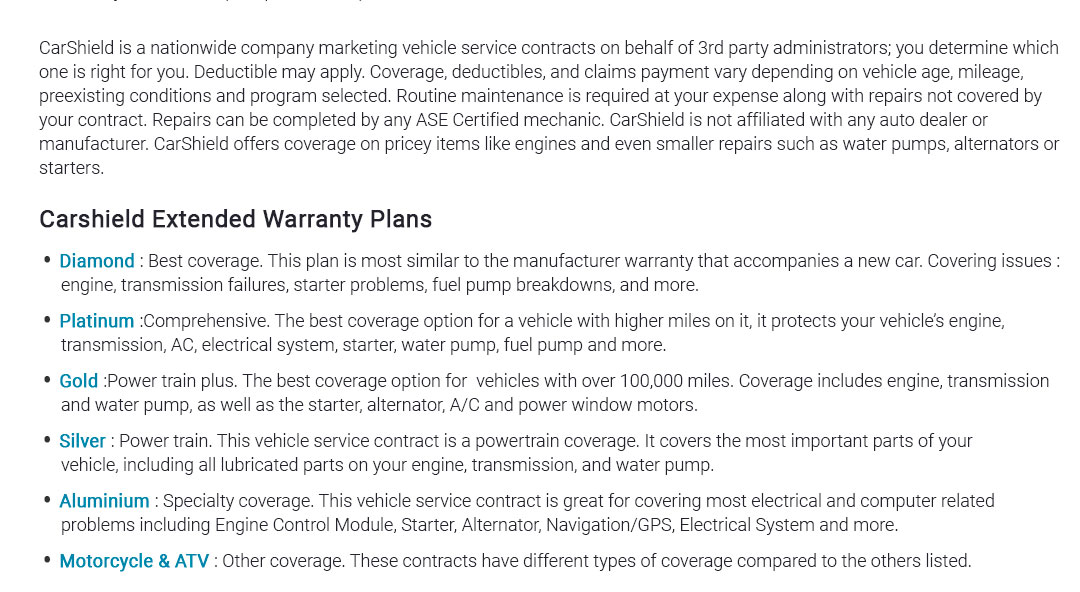

- Coverage scope: powertrain vs. exclusionary lists.

- Labor rate caps and shop network access.

Trim the bill, keep the trust

- Compare a few quotes, then negotiate labor-rate limits.

- Match term to ownership horizon; avoid paying past when you'll sell.

- Set a deductible you can pay in cash today.

- Ask how diagnostics and taxes are handled - small lines add up.

A quick real-world check

On a rainy Thursday my alternator quit at 72k miles; the plan paid $760 on a $980 repair, I covered a $200 deductible. Some say these plans never pay, and that can be true on newer cars; yet on mid-mileage vehicles, clear labor caps built both trust and steady savings.